Application and Verification

Through our Merchant Portal, consumers or merchants initiate the lending process. Applicants then confirm their identity and agree to essential disclosures. In addition, we maintain a network of qualified merchants to provide reliable leads for lenders. Speak to us about opportunities to receive these leads.

Offer Exploration and Selection

Pre-approved applicants are presented with tailored loan offers and directed to a lender-specific interface for finalizing details.

Loan Activation and Disbursement

Once all checks are in place, loans are set in motion, and funds are disbursed to the applicants.

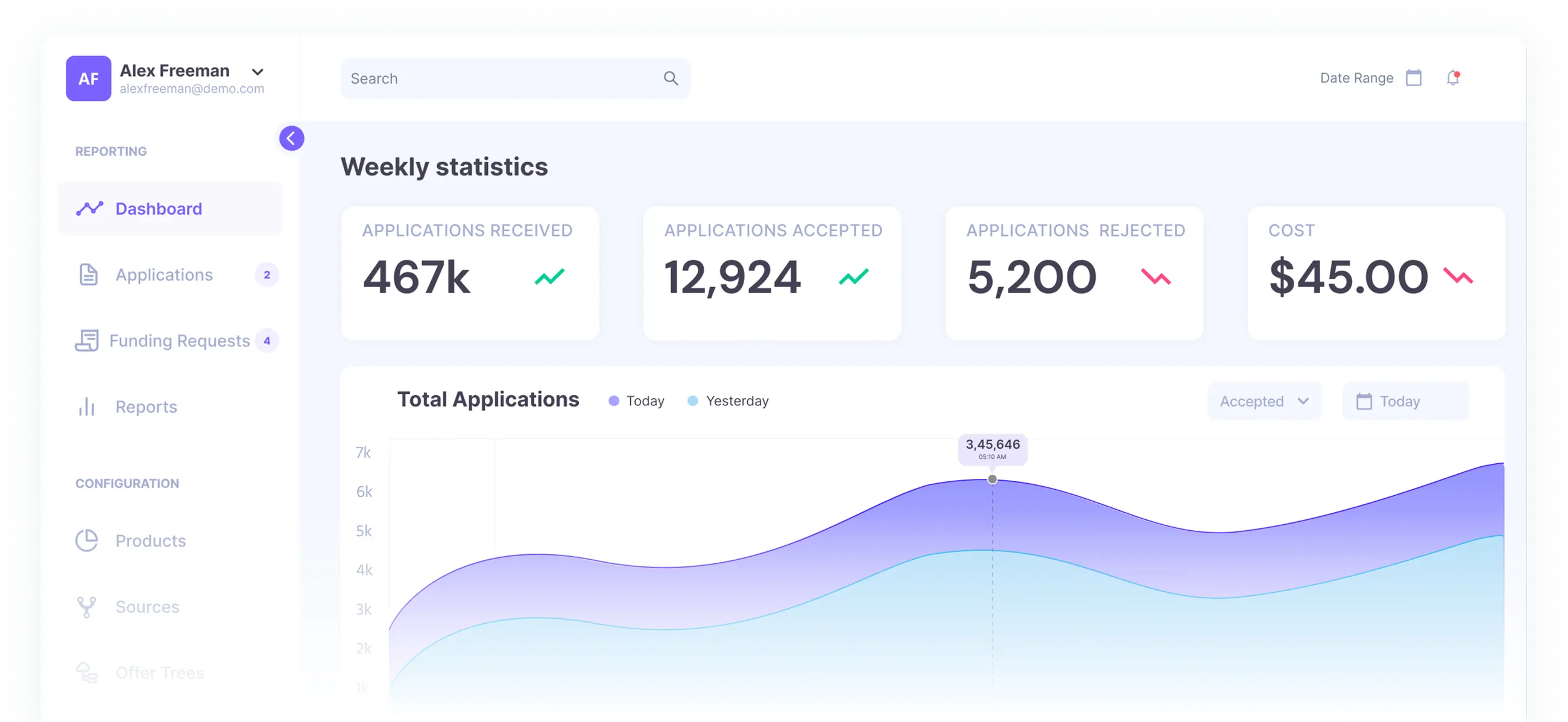

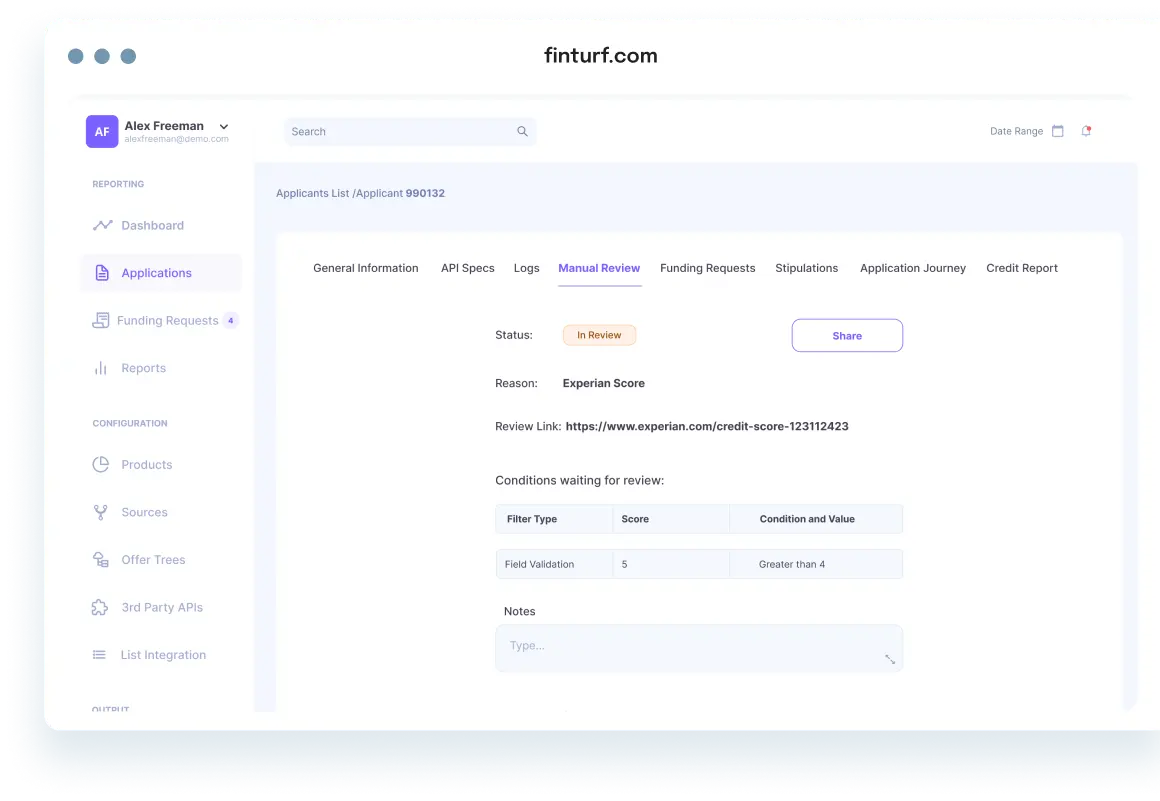

Oversight with Merchant Portal

Merchants leverage our portal to manage leads, monitor application statuses, and receive streamlined communication.