Features Built for Lenders

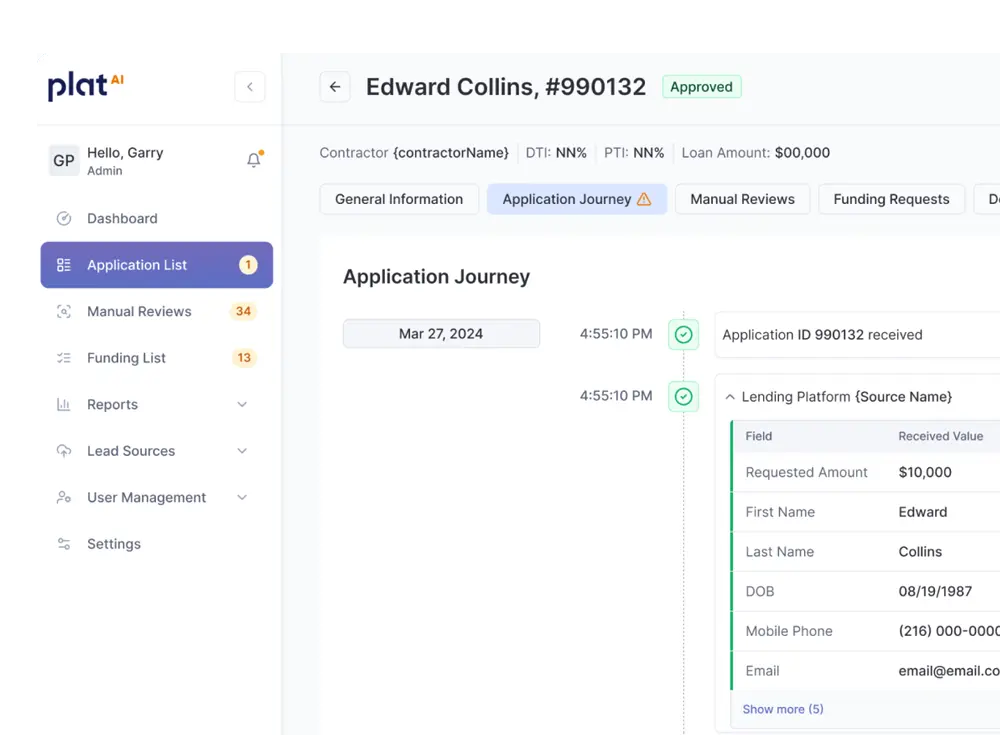

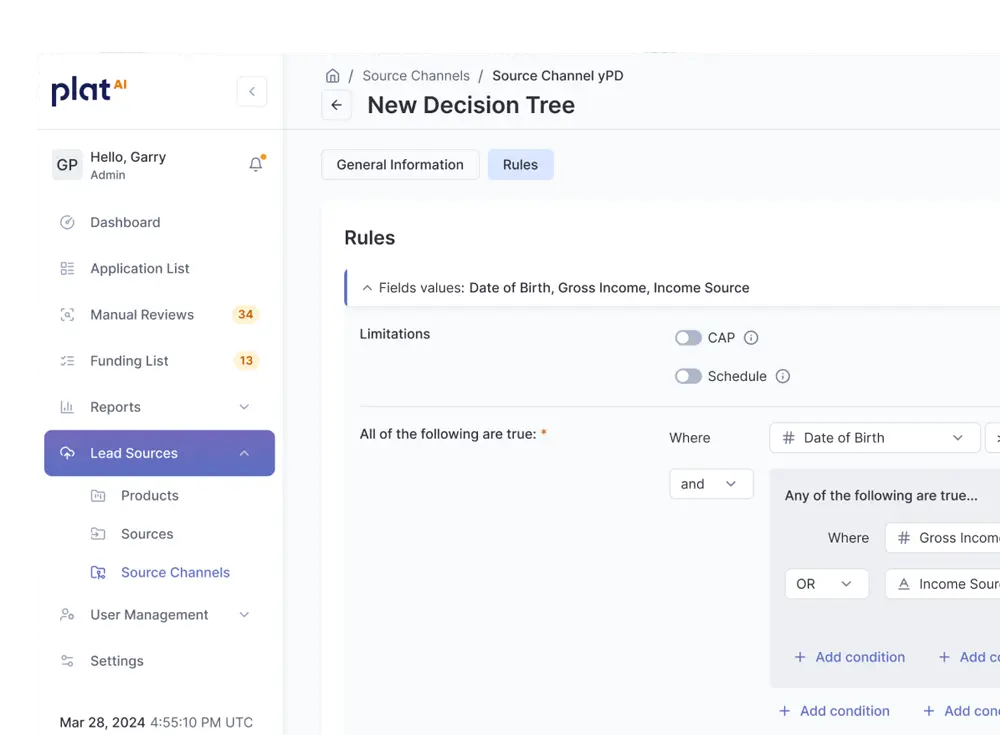

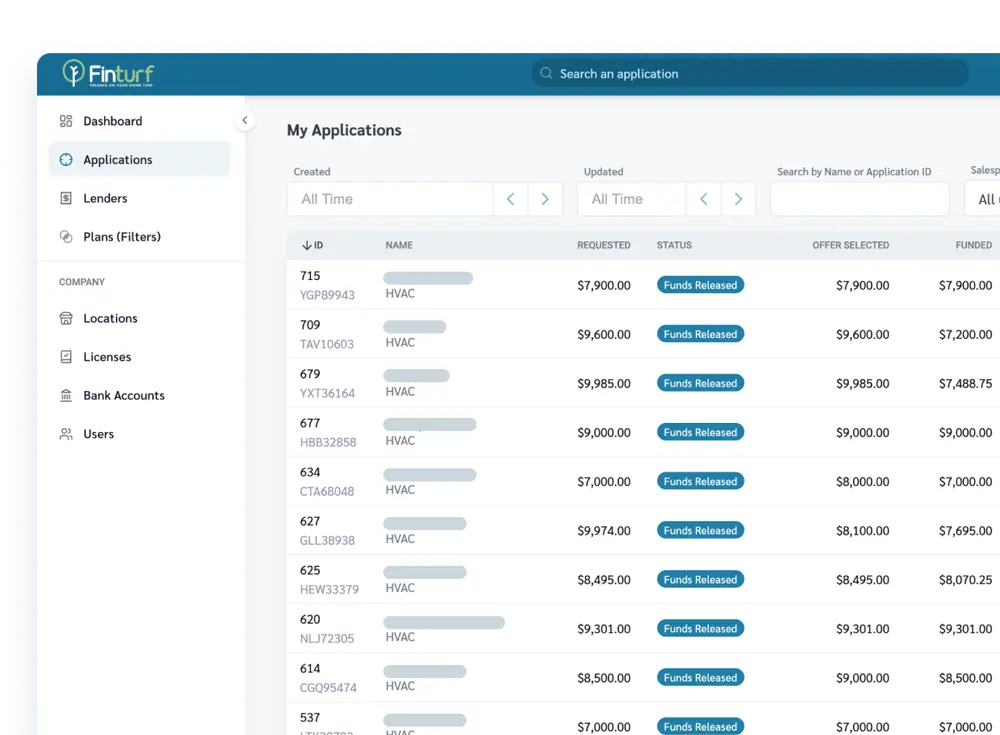

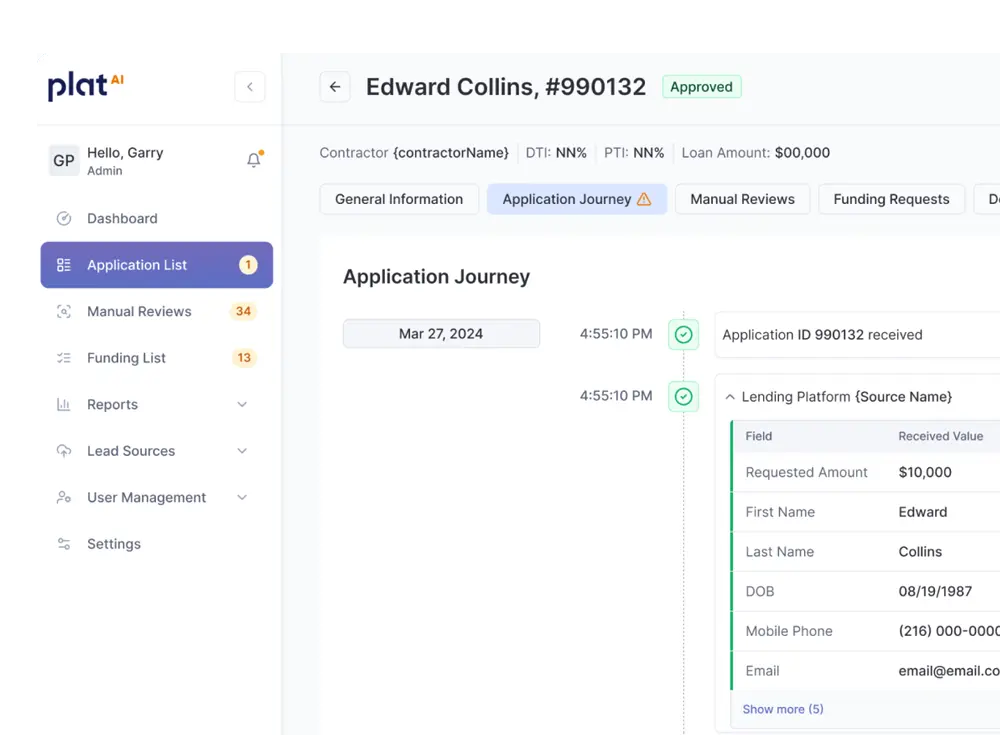

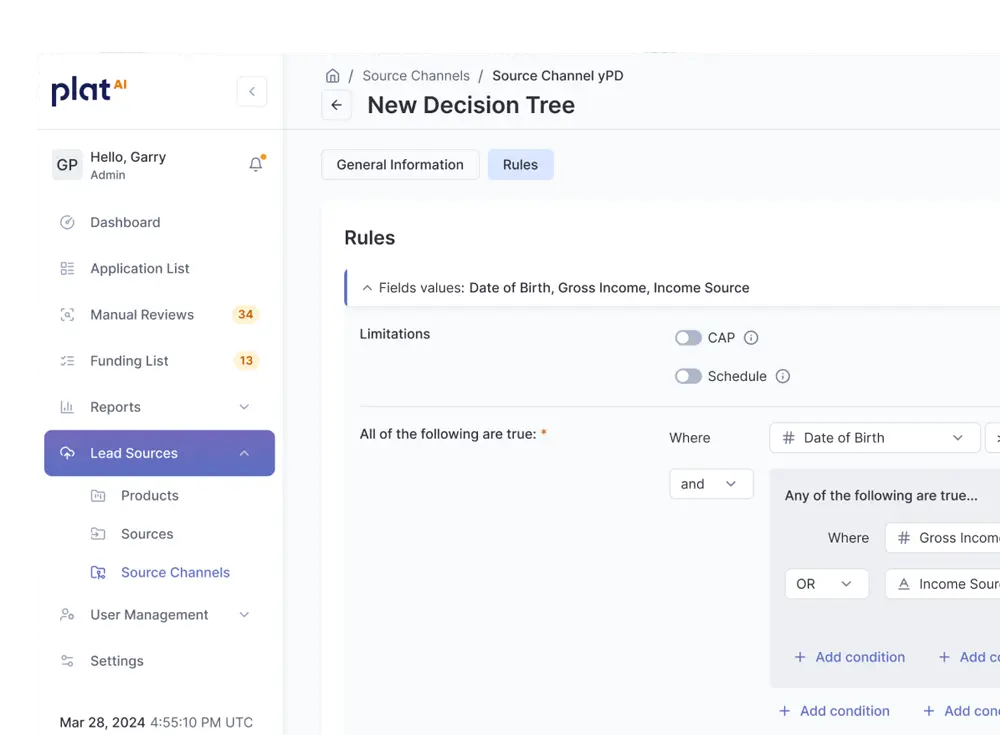

Our LaaS isn’t just a platform; it’s a holistic lending ecosystem. From application initiation to final funding, we’ve got you covered.

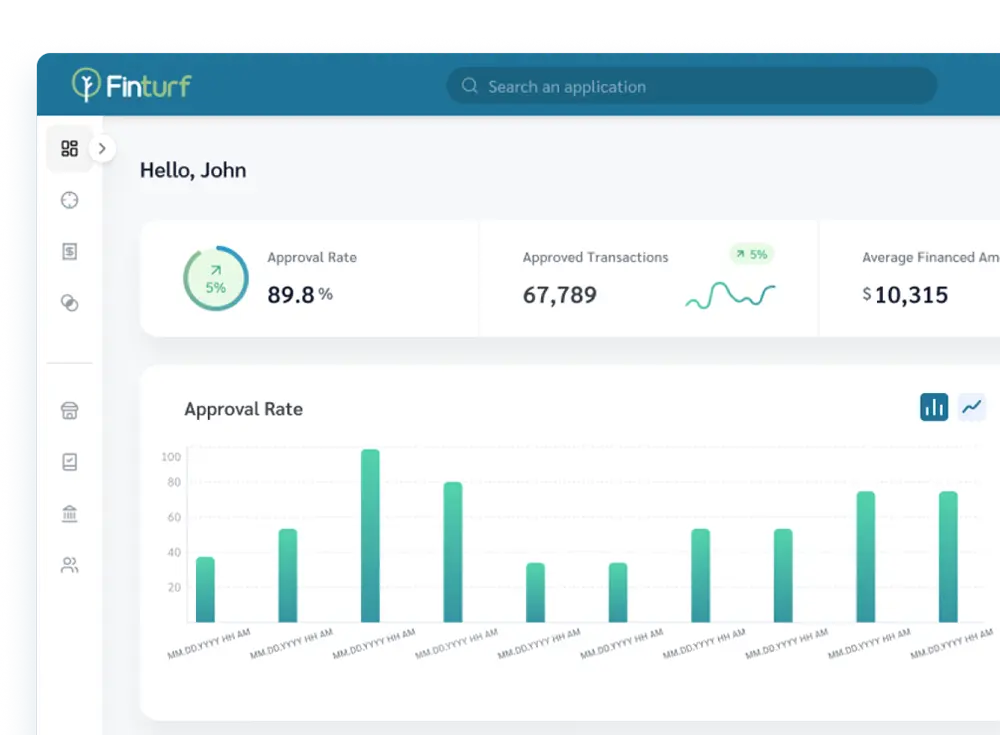

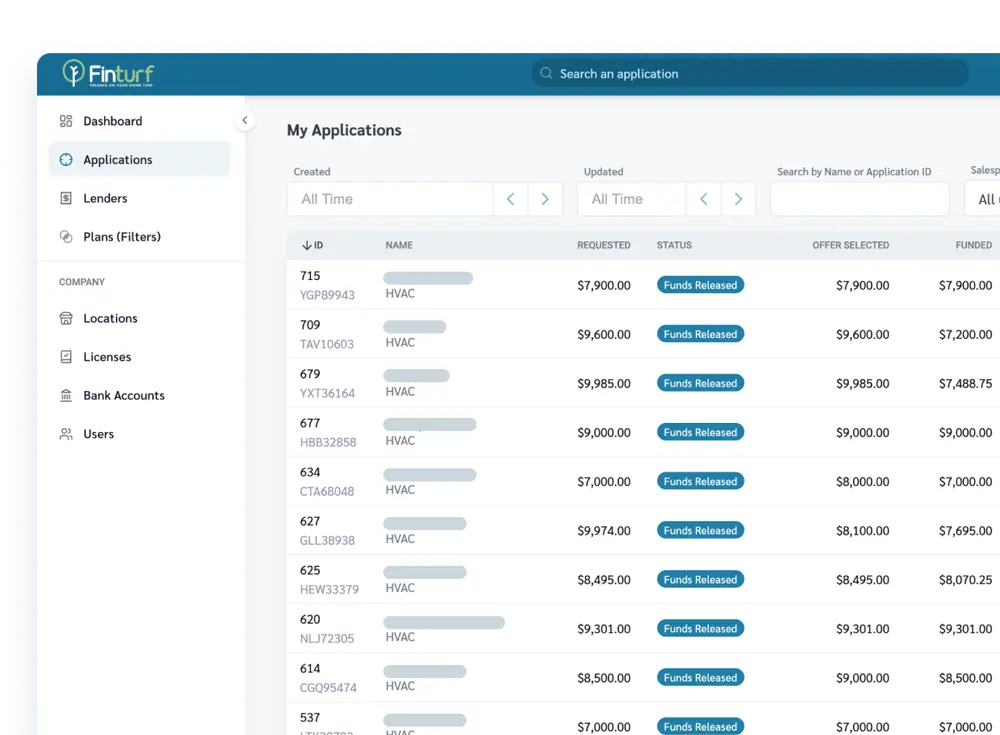

Your Gateway to Point-of-Sale Financing. Finturf handles the tech. You handle the capital.

Our LaaS isn’t just a platform; it’s a holistic lending ecosystem. From application initiation to final funding, we’ve got you covered.

Decades of credit, risk, lending, and payments expertise—guiding a global team of 100+ technology and financing professionals.

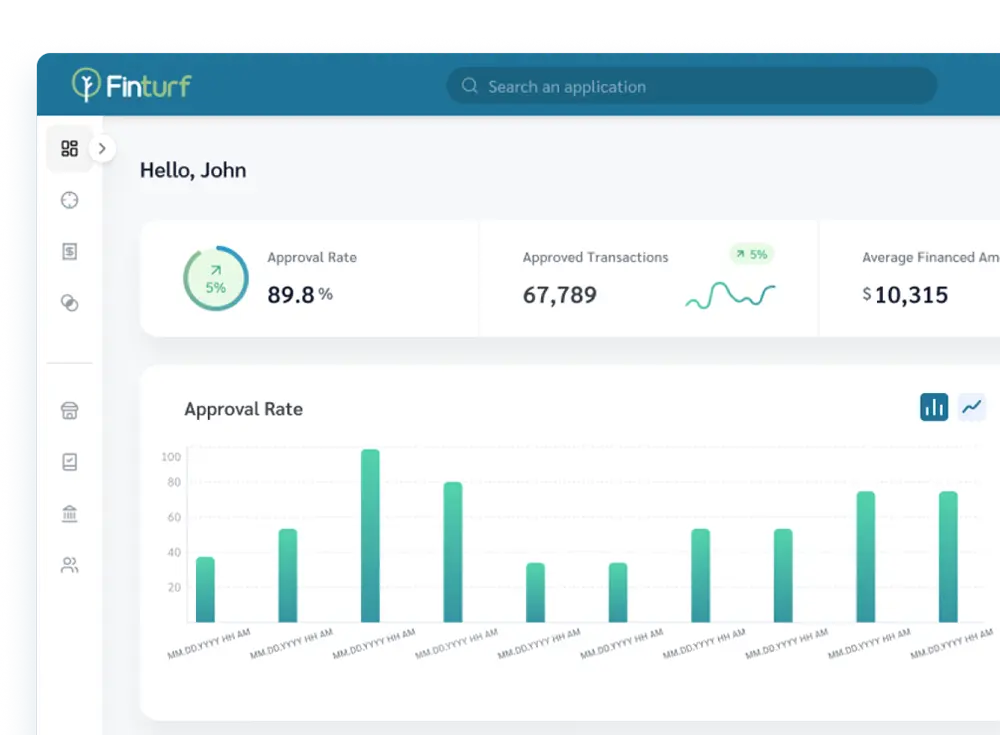

Finturf’s extensive partnerships make it easier for customers with varying credit profiles to find financing options. This translates to more closed deals and revenue for your business.

Finturf delivers best-in-class merchant due diligence, underwriting, and monitoring, ensuring reliable compliance management and consumer protection.

Ensure your business operates smoothly with robust compliance management designed to meet regulatory standards and protect consumer interests.

Thorough contractor underwriting that verifies credentials through KYC, KYB, and background checks, ensuring only qualified merchants are approved.

Safeguard your customers with solutions that prioritize consumer protection, ensuring secure transactions and adherence to industry regulations.

Join the Finturf Revolution Now - Sign Up To Get Started

We will contact you as soon as possible