Pricing is a key ingredient in your business recipe. Set too low, your profits are bland. Set too high, customers walk away hungry. Strategic pricing helps you find the optimal cost to feed both customer demand and your bottom line. In this guide, we break down different pricing strategies, provide real-world examples, and share tips to help you choose the right approach for your business.

Pricing Strategy Definition

Strategic pricing is the process of setting a price that supports your business goals and reflects four pillars at once:

- Customers – what your target buyers are willing to pay, how price‑sensitive they are, and how they perceive value.

- Costs – every direct and indirect expense you must cover to stay profitable, including overhead and future investment.

- Competition – the price points and positioning of rivals that shape customer expectations and influence your room to maneuver.

- Constraints – industry regulations, minimum‑advertised‑price agreements, tax considerations, and other legal or policy limits that can restrict your options.

When these factors are balanced, you land in the “sweet spot” where buyers feel the price is fair, your margins remain healthy, and your brand stands out rather than racing to the bottom on cost. A strategic price can therefore do more than generate revenue; it can attract new customers, reward loyal ones, signal quality, and protect market share against aggressive competitors.

Note: This blog is for educational purposes only. Pricing decisions can carry legal, tax, or contractual obligations. Price differences must not be based on race, gender, age, etc. We recommend consulting a professional advisor before finalizing your pricing strategy.

7 Types of Pricing Strategies

There’s no one-size-fits-all approach to pricing. Different scenarios require different pricing solutions, each with its own benefits, drawbacks, and optimal use cases. Let’s explore seven common pricing strategies and when to use them.

1. Cost-Plus Pricing

To apply a cost-plus pricing strategy, you add a fixed percentage markup to your costs to determine the price. For example, if a contractor estimates a job will cost $1,000 and wants a 20% profit margin, the contractor will charge $1,200 for the job.

Cost-plus pricing aims to help you cover costs and achieve a consistent profit margin. However, it doesn’t consider customer demand, competitor prices, returns, warranty, and overhead allocations, which means it’s not always the most strategic pricing approach.

This strategic pricing model works best when your costs are stable. However, service-based businesses should remain aware of what customers are willing to pay.

2. Competitive Pricing

In a competitive pricing strategy, you set your prices based on what competitors are charging. This strategy is common in markets where businesses offer similar products or services. If you run an HVAC repair service in a town where most HVAC businesses charge about $100 for a service call, you might price between $95 and $105 to stay in line with the market. Since the average order value for HVAC services tends to be higher when additional repairs or maintenance are involved, attracting customers with a competitive base price can lead to more profitable service calls overall.

The idea is to neither price yourself out of the market nor leave too much money on the table. However, if you always match the lowest competitor, you could end up in a price war or with unhealthy margins.

Successful use of competitive pricing requires:

- Analyzing competitor pricing research.

- Deciding whether to price below, match, or above the market.

- Monitoring competitor pricing regularly and making adjustments.

- Implementing added services or loyalty programs to stand out.

3. Penetration Pricing

This strategic pricing model focuses on entering the market with a low price to quickly attract customers and gain market share. It’s often used for pricing new products or services. For example, a new home cleaning service might offer an initial cleaning for 50% less than the regular rate to attract clients.

A penetration pricing strategy sacrifices short-term profit, with margins often razor thin or even break-even, in the hopes of achieving long-term gains. After building a loyal base, a business will typically raise prices to normal levels.

The risks associated with this pricing strategy are obvious. If prices are too low for too long, you could damage your profitability. You could also struggle to raise prices without damaging your brand’s reputation and customer loyalty.

Another risk is legal exposure, as some jurisdictions have statutes prohibiting below-cost selling and predatory pricing.

4. Price Skimming

Skimming is the inverse of penetration. In this case, a business starts with a high price to “skim” the segments of the market willing to pay more and then gradually lowers the price over time. This strategic pricing model is commonly applied to innovative or high-tech products.

For instance, a smartphone manufacturer might launch a new model at a premium price, targeting early adopters who want first access to cutting-edge technology. As the offering becomes more commonplace or as competitors enter the market, the price is reduced to capture more price-sensitive customers. Price skimming aims to maximize profit from the most eager customers upfront.

The challenge of this pricing strategy is that the initial high price may deter some customers. You also have to be careful not to alienate previous customers when you eventually drop the price.

5. Value-Based Pricing

This strategy sets prices according to the perceived value rather than the cost. Suppose your home improvement business offers a renovation with a 10-year warranty and exceptional craftsmanship. In that case, the value to the customer is higher, and the price of the project can be set accordingly — even if your costs are similar to those of your competitors.

The key to value-based strategic pricing is communication. You must convey why your offering is worth the higher price. This pricing strategy can lead to higher profit margins by capturing the additional value you deliver. However, if you don’t truly deliver value, customers may feel overcharged.

Perceived value can vary widely from customer to customer. Value-based pricing often works best with tailored offerings to segmented or niche markets, capitalizing on what specific customer bases value most.

6. Dynamic Pricing

In a dynamic pricing strategy, you might raise or lower prices in response to demand or availability. For example, airline ticket pricing fluctuates constantly based on the number of seats remaining, how soon the flight date is, and customer demand.

When demand is high, you can capture more value by charging higher prices. When demand is low, you attract price-sensitive customers by charging lower prices. Note that dynamic pricing must be used carefully. If customers perceive prices as changing too often or unfairly, it can lead to distrust.

7. Tiered Pricing

Tiered pricing divides your offering into different levels or packages, each with a corresponding price point. By offering tiers, customers self-select into a price level they’re comfortable with. When designed well, this can increase overall sales and customer satisfaction.

Tiered pricing is particularly effective for service-based businesses, especially SaaS models. The benefit is that it can maximize revenue. Your high-end customers who want more features or better service will pay for a premium tier, while budget-conscious customers can still engage at a lower tier rather than opting out entirely.

The challenge is in defining the differences between tiers and ensuring customers receive proportional value as prices increase. When implemented effectively, a tiered pricing strategy can also encourage customers to upgrade as they come to appreciate the additional value in higher tiers.

Tips for Strategic Pricing

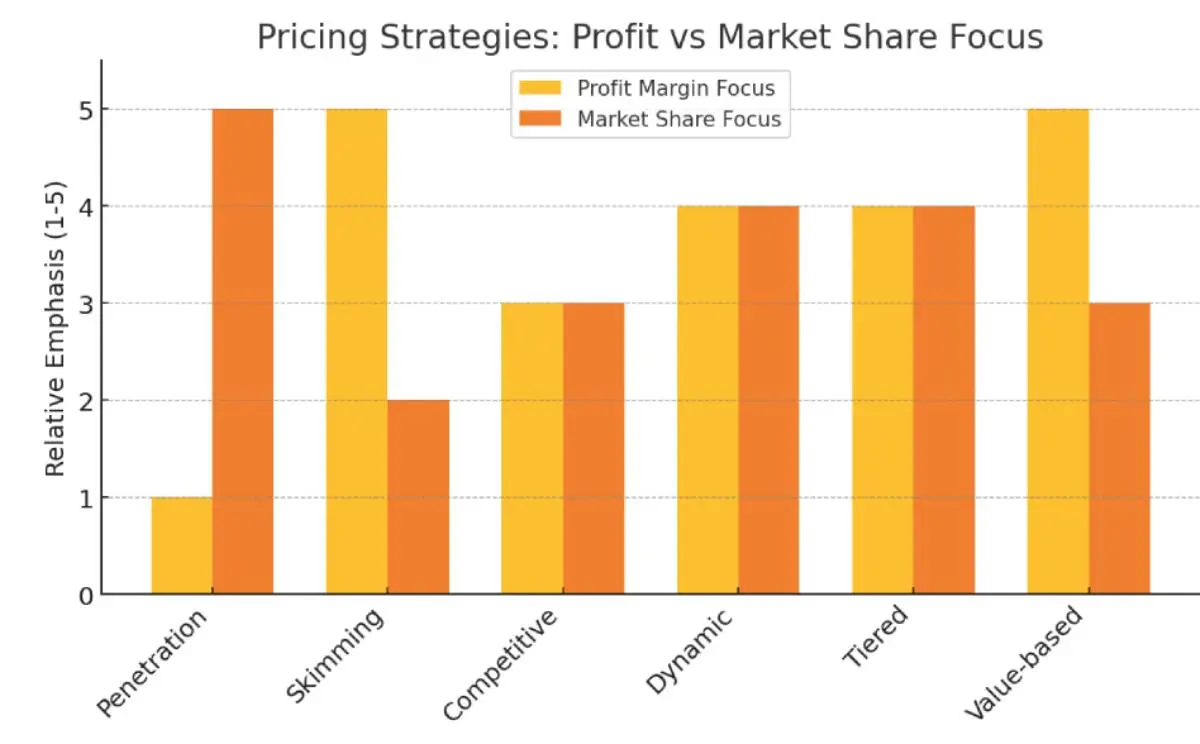

Pricing strategies aim to strike a balance between profit margin and market share. For example, penetration pricing prioritizes volume over profit, while price skimming prioritizes margins over market reach. Dynamic and tiered pricing strategies achieve a healthy mix of profit margin and market share by adjusting to customer segments or demands.

Each of these strategies can be effective, but they serve different purposes. Sometimes, a business even implements a combination of pricing strategies. For instance, a business may use competitive pricing for basic services and value-based pricing for premium offerings.

To determine the most effective strategic pricing for your business, consider your costs, customers, and competition, and then select a model that best suits your situation. In the next section, we discuss how to make that choice in more detail.

How to Choose the Best Pricing Strategy

With so many pricing strategies available, consider the below factors to decide which is best for your business.

Analyze Industry and Competition

Understanding the standard pricing in your industry will help frame your approach. Are you in a highly competitive market with thin margins or a specialized industry with few competitors? Perform a competitive pricing analysis by researching what direct competitors charge for similar products or services.

If you find most competitors cluster around a specific price range, that’s the baseline your customers are seeing. This doesn’t mean you must match it, but if you diverge significantly, your strategy should justify it.

Identify Business Goals

Your pricing strategy should align with your broader business objectives. If your priority is rapid growth, penetration pricing or competitive pricing might make the most sense for your goals. If profitability is a concern, calculating operating cash flow can help guide your decision toward value-based or cost-plus pricing to ensure healthy margins.

Also, consider the lifecycle of your product or service. You might price differently when launching a new offering than when you’re established or facing more competition. Align the strategy with what you need most, be it market share, profit margin, or customer retention.

Understand Customer Behavior and Perception

In the end, the “right” price is one your customers are willing to pay. Consider your target customers. Are they extremely price-sensitive? Do they equate higher prices with higher quality?

Understanding price elasticity — the change in demand resulting from price changes — for your service or product is important. If small price changes have a significant effect on demand, you’re in a sensitive market and likely need to stay competitive or justify a higher price with clear added value. If your demand is relatively inelastic, you have more leeway to charge premium rates for a unique service or product.

Finally, consider psychological pricing aspects. Would bundling services or offering tiered options increase the customer’s perceived value?

Factor in Costs and Profits

The strategic pricing model you choose should cover your costs. Calculate all relevant expenses, including overhead costs like labor, rent, insurance, utilities, and even marketing.

Time is money, especially for service-based businesses. Be sure to account for all labor hours when considering pricing, including time spent calculating quotes or following up with clients. Once you know your break-even point, consider your desired profit margin.

Consider Legal or Policy Constraints

In some industries, external rules may influence pricing strategy. A prime example is a Minimum Advertised Price (MAP) policy. If you’re a retailer or distributor selling a manufacturer’s product, they may require that you do not advertise below a certain price. For instance, a manufacturer might set a minimum advertised price of $500 for a product, meaning all authorized resellers must publicly advertise the product at $500 or above.

A supplier may implement a MAP pricing policy to maintain brand value and price consistency. Violating a MAP agreement can lead to penalties or damage supplier relationships.

Keep these policies in mind when setting your prices or promotions, especially if your business model depends on reselling supplier products.

Test and Iterate

Once you’ve selected a strategic pricing model, test it out. This could be as simple as feedback from a few trusted customers or as formal as running A/B tests. For a service business, you might quote slightly different pricing strategies to different clients (where appropriate) as an experiment or try a limited-time offer to gauge interest.

Pay attention to how customers react. Are sales increasing? Do customers express any resistance to the price? Also, closely monitor your financial metrics — including revenue, profit margins, and sales volume — to see if the strategy is delivering as intended. Strategic pricing is not a ‘set it and forget it’ exercise. Markets change, so should your pricing.

How to Raise Prices Without Losing Customers

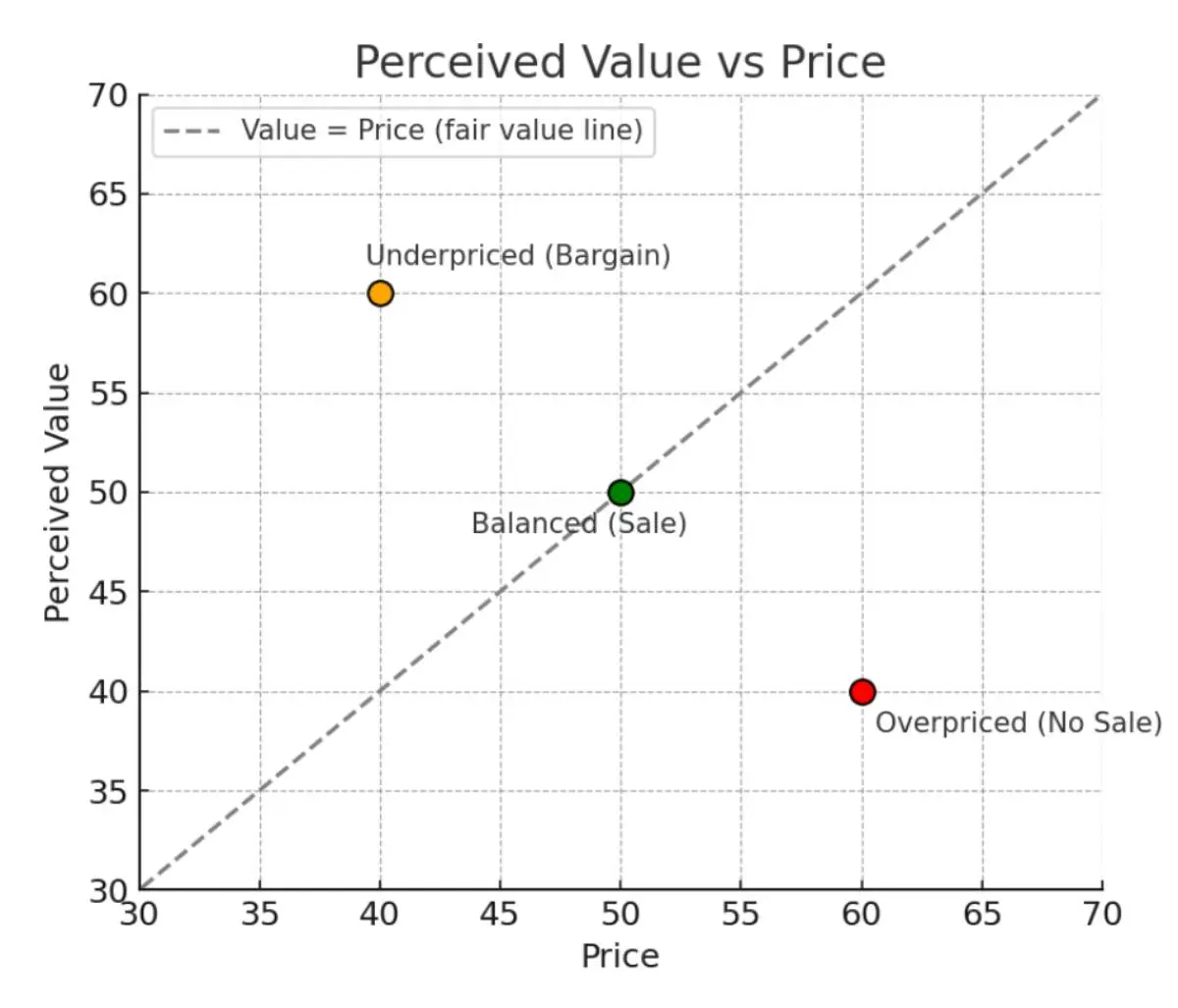

Customers are more willing to accept a price increase when they perceive the value as rising as well. In the chart below, the green point represents a sale where the price and perceived value are in balance. The red point represents an overpriced scenario. The orange point represents an underpriced scenario.

The goal of a strategic price increase is to move from the orange point closer to the green, increasing price while maintaining or enhancing the value perception. You don’t want to slip into the red overpriced territory.

Established businesses often worry that increasing fees will drive away loyal customers. While some attrition is always possible, here are proven ways to minimize the loss:

- Value First: Don’t lead with, “We’re increasing prices.” First, reinforce the value and improvements in your offering. Highlight new features, enhanced upgrades, or improved service. By the time you mention the price increase, customers will understand the associated benefits.

- Flexible Options: When you raise prices, it’s wise to ensure customers have choices. This is where tiered pricing or bundles can help. If a customer can’t afford the new price of your top-tier service, they could downshift to a basic plan or a smaller package rather than leave entirely.

- Appreciation: Thank customers for their business and, if possible, reward loyalty. When implementing a price hike, a home service business may offer a complimentary add-on service (like a free gutter cleaning) to loyal customers during the transition.

FAQ

When Should You Use Promotional or Discount Pricing?

Promotional pricing (temporary discounts, coupons, or limited-time offers) works best to boost short-term demand, clear excess inventory, or introduce a new service. Use it strategically around slow seasons, product launches, or special events, but avoid relying on promotions. They can condition customers to wait for deals and erode your perceived value.

How Can You Measure the Success of Your Pricing Strategy?

Track key metrics before and after any pricing change, including revenue per sale, overall profit margin, sales volume, and customer acquisition and retention rates. Conduct win-loss analysis on quotes or promotions, gather customer feedback on price perception, and monitor competitor movements.

How Often Should You Review and Update Your Pricing Strategy?

Quarterly pricing reviews are one way to see if your strategy aligns with market shifts, cost changes, and customer expectations. However, you may need to review more frequently.

Why Should Service Technicians Be Familiar with Company Pricing Policies?

Service technicians are often the first point of contact when customers ask questions about costs or request add-on work. If they understand your pricing policies — what’s included in each service tier, how discounts work, and when upsells are appropriate — they can answer questions accurately and confidently.